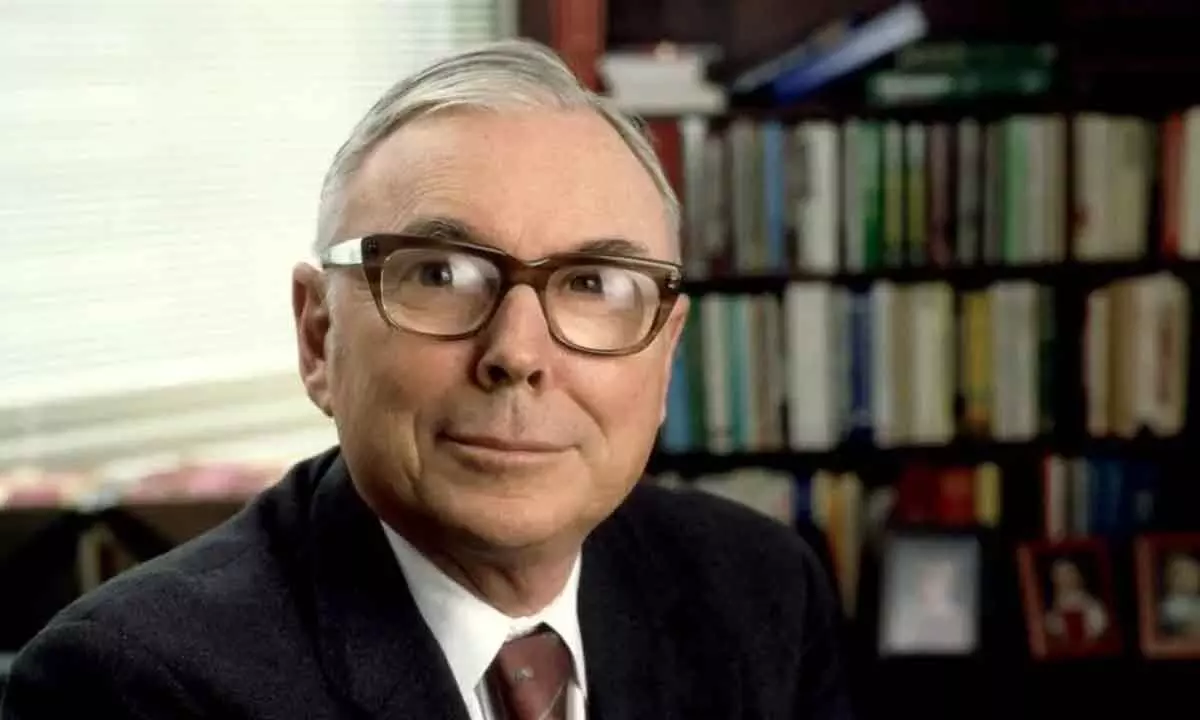

Beyond buy low, sell high: Charlie Munger’s timeless principles for investment success

His emphasis on constant learning, rational thinking, deferred gratification, and concentrated bets remains as relevant today as ever

image for illustrative purpose

This New Year let us revisit his famous quotes and investing philosophy that could serve us a path for the investment journey into the coming year

Last month, the legendary investor Charlie Munger passed away at the age of 99. Reports indicate that he had planned a birthday celebration for New Year’s Eve, which would have marked his 100th birthday, surrounded by close family and friends.

Munger is credited for the evolution of investment philosophy of his partner and charismatic chairman of Berkshire HathawayWarren Buffett. Warren learnt from his profession & guru, Ben Graham to use analysis to identify companies that might be troubled but whose stock is deeply undervalued. Munger persuaded Buffet to change his stance of ‘buying a fair company at a wonderful price’ to ‘buying a wonderful company at fair price’.

This New Year I would like to revisit his famous quotes and investing philosophy that could serve us a path for the investment journey into the coming year. On being a constant learner himself and belief on learning, he quoted: ‘I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they’re learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you’. On the requirement of intelligence for investing, he says, ‘A lot of people with high IQs are terrible investors because they’ve got terrible temperaments.’ Of course, he also lists the qualities of a such investors as, ‘The great investors are always very careful. They think things through. They take their time. They’re calm. They’re not in a hurry. They don’t get excited. They just go after the facts and they figure out the value. And that’s what we try to do.’

His belief on reading, ‘In my whole life, I’ve known no wise people (over a broad subject matter area) who didn’t read all the time - none, zero. You’d be amazed how much Warren reads and at how much time I read. My children laugh at me. They think I’m a book with couple of legs sticking out.’ And further opines that, ‘there is no better teacher than history in determining the future. There’re answers worth billions of dollars in a $30 history book.’

It's not just about reading and learning but being open to ideas is critical. ‘We all are learning, modifying or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side.’ This is important in investing as it challenges the various biases each of us carry and allows us to overcome them.

On leading a simple life and within means, he says. ‘Live within your income and save so that you can invest. Learn what you need to learn.’ Both Warren and Charlie were exemplary in living well below their means, with both having lived for decades in the same house even as he got richer and his rich friends built bigger and better houses.

He further says, ‘It’s so simple to spend less than you earn and invest shrewdly. Avoid toxic people and toxic activities and try and keep learning all your life and do a lot of deferred gratification. If you do all these things, you are almost certain to succeed. If you don’t, you’re going to need a lot of luck.’

In investing, he was keen to take concentrated bets. ‘If you want to be a good investor, you have to have a long-term perspective. You have to be willing to be very patient and wait for the right pitch. And when you get the right pitch, you have to be ready to swing hard. You can’t just take a little teeny tiny swing. You have to swing with all your might.’ And furthering this attitude, he quotes as ‘When you know you have an edge, you should bet heavily. They don’t teach most people that in business school. It’s insane. Of course, you’ve to got to bet heavily on your best bets.’ He emphasizes on playing heavily on the convictions and taking advantage when one finds a clear edge. Wishing you all a Very Happy and Prosperous New Year!!!

(The author is a co-founder of “Wealocity”, a wealth management firm and could be reached at [email protected])